Nawaloka Hospitals PLC (NHL) Vs Asiri Hospital Holdings PLC (ASIR)

Nawaloka Hospitals PLC (NHL)

Established in 1985, Nawaloka hospitals group currently has four subsidiaries namely New Nawaloka Hospitals (Private) Limited, New Nawaloka Medical Centre (Private) Limited, Nawaloka Medicare (Private) Limited and Nawaloka Green Cross Laboratories (Private) Limited. The organization is considered as a pioneer in the Sri Lankan healthcare sector and was listed on the CSE in 2004. (Source:

Nawaloka Hospitals PLC Annual Report 2019)

Asiri Hospital Holdings PLC (ASIR)

Established in 1986, the Asiri Health Group currently operates seven hospitals in three provinces and also operates Sri Lanka’s largest laboratory service. The group is considered to be the largest private healthcare provider in Sri Lanka. (Source: Asiri Hospital Holdings PLC Annual Report 2019)

Section 01 – Ratio analysis and performance assessment of the two organizations

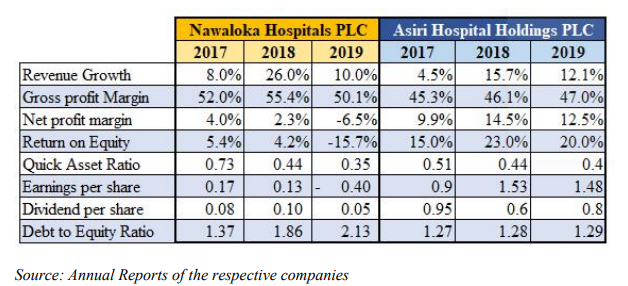

Profit Margins

The gross profit margin of ASIR has been following an increasing trend over the past three years and has increased from 45.3% in 2017 to 47.0% in 2019. On the other hand the gross profit margin of NHL

increased from 52.0% in 2017 to 55.4% in 2018. However in 2019, the gross profit margin has dipped to

50.1% which is even below the level it was in 2017. When comparing the two organizations, NHL has a

higher gross profit margin compared to ASIR despite a decrease in the margin in 2019.

When comparing the net profit margins, ASIR has a significantly outperformed NHL. ASIR has managed to maintain its net profit margin in the range of 9.9% to 14.5% over the past years whereas NHL’s net margin has considerably deteriorated over the same period from 4.0% in 2017 to -6.5% in 2019 which is an area of concern for NHL.

Overall, when considering the profitability margins, ASIR has performed better than NHL even though NHL has a higher gross profit margin as ASIR has an increasing trend in its gross profit margin and also a significantly better net profit margin compared to NHL.

Return on Equity

Return on Equity is an indicator of how efficiently an organization utilizes the funds of its shareholder or in other words it measures the profitability of the organization compared to the shareholder’s equity. NHL has failed to generate profits from the shareholders’ equity and the return on equity has been diminishing over the past three years from 5.4% in 2017 to a -15.7% in 2019. ASIR has managed to constantly record a better return on equity comparative to NHL as their return on equity has been in the range of 15.0% to 23.0% over the past 03 years.

Quick Asset Ratio

Quick asset ratio depicts ability of the organization to pay its current liabilities using the organization’s more liquid current assets. The quick asset ratio of both the organizations have been depleting over the last three years and both the organizations are not in good liquidity position to cover up their current liabilities as at the financial year ended 2019. The quick asset ratio of NHL deteriorated from 0.73 in 2017 to 0.35 in 2019 while ASIR’s quick asset ratio deteriorated from 0.51 in 2017 to 0.40 in 2019.

Debt to Equity Ratio

NHL and ASIR both have more debt in their capital structure compared to equity. However NHL has a

significantly higher debt compared to equity especially as the end of the financial year 2019. NHL’s debt

equity ratio has substantially increased over the past 03 years from 1.37 in 2017 to 2.13 in 2019, primarily due to the increase in borrowings over the past few years. Whereas ASIR has managed to maintain a relatively stable debt to equity ratio which slightly increased from 1.27 in 2017 to 1.29 in 2019. Considering that higher debt is mostly related to increase in the risk in the organization, ASIR seems to be in a better position than NHL when considering this ratio.

Section 02 – Investment decision on selecting the better investment opportunity out of the two aforementioned companies

When making an investment decision is it important to take into consideration both the quantitative and qualitative factors. Based on the latest financial performance and ratio analysis and looking purely from a financial perspective ASIR looks to be the better option as better profit margins, provides a better return on equity and also has a relatively less risky capital structure with lower proportion of debt compared to the capital structure of NHL.

NHL’s ratios have been deteriorating over the past few years, however if we dig deeper into reasons for the depletion of these ratios, the primary reason would be their high level of investment over the recent years as they expand and develop their business. Main investments were on the opening of the 14 storied Nawaloka Specialist Care Centre with a new channelling system and with a large car park with parking facility available 550 vehicles and also the opening of the Nawaloka Premier Wellness Centre in financial year 2018/2019 (Source: Annual Report 2018/2019).

NHL also plans to invest Rs.350 million for the expansion of its hospital in Negombo with a six-storied building would expand the service of OPD, ETU, Pharmacy, Channel consultations and inward patient rooms (Source: bizenglish.adaderana.lk). NHL also has a clear direction for the organization’s future strategies as they are looking forward to adapt the concept of ‘smart hospitals the next 10 years. This concept is mainly focused of tracking and analysing the vast the amount of data collected through hospitals and with the help of Artificial intelligence plans to develop new technologies for therapeutics such as stem therapy, biotechnology, robotics, surgeries, and personalised medicine, and these would be the future of the healthcare industry. NHL already having clear strategies on these technologies would provide them a competitive over their peers.

On conclusion, NHL would be the better organization to invest in as they have clear future strategies compared to ASIR and also even though their financial ratios have recently depleted due to high level of investments, those investments are likely to generate high returns for the organization in the long term.

References – Just As An Indication – Follows No Referencing Guideline

Asiri Hospital Holdings PLC Annual Report 2017

Asiri Hospital Holdings PLC Annual Report 2018

Asiri Hospital Holdings PLC Annual Report 2019

Nawaloka Hospitals PLC Annual Report 2016/2017

Nawaloka Hospitals PLC Annual Report 2017/2018

Nawaloka Hospitals PLC Annual Report 2018/2019

Nawaloka Hospitals goes for Rs. 350 mn expansion in Negambo (http://bizenglish.adaderana.lk/nawaloka- hospitals-goes-for-rs-350-mn-expansion-in-negambo/)